The California Department of Tax and Fee Administration (CDTFA) modified its rules regarding cannabis excise taxes. The new rules became effective January 1, 2023. The major changes that affect cannabis consumers are:

- Cannabis retailers are now responsible for collecting the cannabis excise tax from purchasers at the time of the retail sale of cannabis or cannabis products.

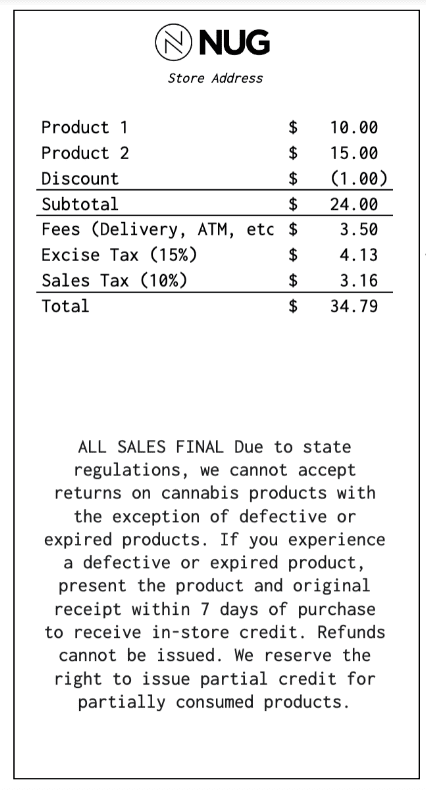

- The cannabis excise tax must be listed separately on the receipt or invoice provided to the purchaser.

- The cannabis excise tax is included in gross receipts subject to sales tax.

Prior to January 1, 2023, State Excise Tax was accessed when a retailer purchased cannabis products from a wholesale vendor. The retailer then had to build the excise tax into the retail selling price of cannabis products. The excise tax was not shown on the customers receipt. Instead, a statement that said ‘State Excise Tax is included in the retail price of all cannabis goods” was included on customer receipts.

Under the new regulations customers will see a new line item on their receipts for State Excise Tax. The current excise tax rate is 15%. Customers will also see this excise tax included in the determination of sales tax. All of these changes add up to over a 15% increase in cost to the consumer.

In an attempt to help relieve some of this pain, NUG actually lowered its retail list prices for the vast majority of products in our stores. NUG customers will see higher out-of-pocket amounts, in general. But within NUG stores we are trying to absorb some of this increased expense for you. We are also rolling out a brand-new rewards program that will provide incredible deals to our loyal customers.

When you visit a NUG store your new sales receipt will look something like this: